Today we’ll dive deep into the comparison between Discovery Health vs BestMed.

Curemed is an Independent Financial Advisory Firm specialising in Medical Aid. We are committed to seeking the best healthcare solution for you and your loved ones. Operating independently allows us to provide unbiased assistance to our clients as opposed to favouring a specific Medical Aid provider. Curemed works alongside the Top Eight Medical Aids in South Africa, ensuring you receive comprehensive care when it matters the most. To see the full list of optimal Medical Aids, refer to: 8 of the best Medical Aids to join in South Africa.

Our knowledgeable Medical Aid Advisors simplify the complexities surrounding healthcare solutions. Empowering you with necessary information used to select the right Medical Aid suited to your needs. Curemed’s team of Medical Aid Advisors, can assist you with obligation free, comparative, and personalised quotes.

Get a comparative Medical Aid quote today!

Table of Contents:

- Discovery Health vs BestMed

- Standard Medical Aid Plans

- Comprehensive Medical Aid Plans

- Premium Medical Aid Plans

- Prices

- Reviews

- Conclusion

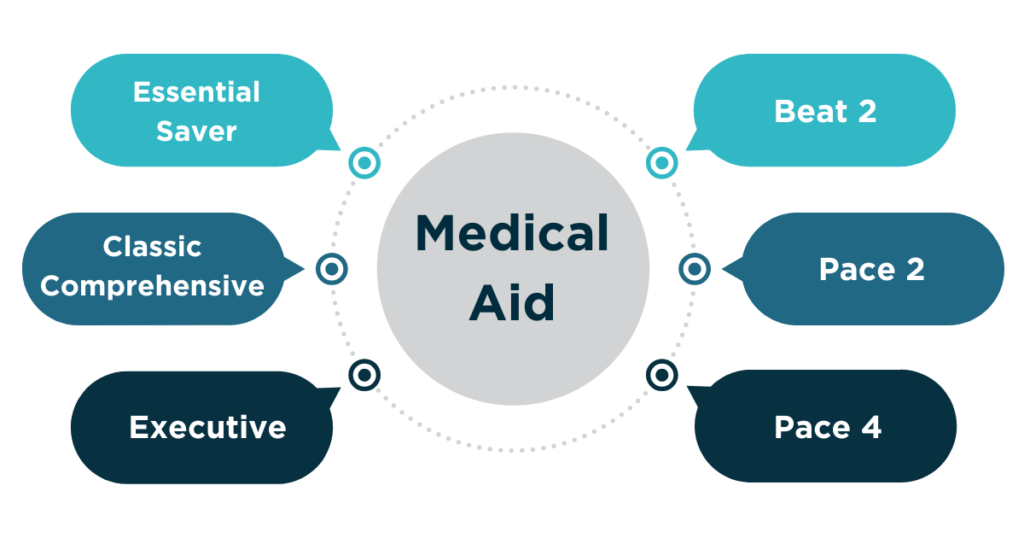

Discovery Health versus BestMed

Discovery Health and BestMed are well-known service providers nationwide. A detailed comparison between Medical Aids, gives you access to vital information used to identify the best Medical Aid for your individualised needs. We review the most popular Medical Aid plans ranging from standard, comprehensive and premium health solutions. Furthermore, Curemed is #alwaysthereforyou with sound advice throughout the overwhelming process of sifting through Medical Aids.

It is important to note that decisions regarding your Medical Aid shouldn’t be based on our comparison alone. As Financial Advisors specialising in Medical Aid, we strongly advise you to get in touch with our experienced team to discuss relevant Medical Aids based on your needs and your pocket.

Standard Medical Aid Plans

Essential Saver from Discovery Health

The Essential Saver offers substantial in-hospital coverage along with day-to-day savings which can be used according to your specific needs. Essential Saver provides cost-effective access to premium health services. With Discovery Medical Aids, child dependants are 0 to 20 years old. Adult dependants are 21 years or older.

Beat 2 from BestMed

Beat 2 offers extensive in-hospital cover with access to day-to-day savings that can be used for general medical expenses. The plan is an affordable solution with access to private healthcare. With BestMed’s Medical Aids, you pay for a maximum of three children. Additional children will be added as beneficiaries at no extra cost. Children under 24 years old and registered students up to 26 years old, as per BestMed guidelines, are considered child dependants and qualify for child dependant rates.

| Service Provider | Discovery Health | BestMed |

|---|---|---|

| Plan name | Essential Saver | Beat 2 |

| Extensive in-hospital cover | ✔︎ | ✔︎ |

| Savings account for day-to-day benefits | R334 | R407 |

| Hospitals for planned procedures | Any | Any |

| Co-payments | Co-payments vary according to procedure taking place | No co-payments unless voluntary use of non-Designated Service Providers (DSPs) |

| Oncology (Cancer) Benefits | ✔︎ | ✔︎ With the option to upgrade plans within 30 days of being diagnosed |

| Chronic Illness Cover | 27 Chronic Conditions Covered | 27 Chronic Conditions covered & 18 Prescribed Minimum Benefits (PMBs) covered |

| Preventative Care Benefits | ✔︎ | ✔︎ |

| Dependants | Child Dependant Premiums applicable up to age 21. | Child Dependant Premiums applicable up to age 24 and registered students under age 26. |

Comprehensive Medical Aid Plans

Classic Comprehensive from Discovery Health

The Classic Comprehensive Medical Aid includes a wide range of in-hospital cover and supplementary medical benefits. 25% of your monthly payment goes towards your savings which can be used at your discretion. It is important to consider the needs of yourself and your beneficiaries when going through Medical Aid options. Consider if your needs, such as chronic illnesses, are covered by the Medical Aid. Take into account if you have any planned procedures on the horizon, determine if they will be covered by the Medical Aid.

Pace 2 from BestMed

Recommended to those seeking complete in and out of hospital benefits as well as savings for additional healthcare. Your savings are made up from 14% of your monthly premium. Once your savings are used up, you will have to pay out of pocket where necessary. Similarly to the Beat 2, families on the Pace 2 plan will only pay for a maximum of three children.

| Service Provider | Discovery Health | BestMed |

|---|---|---|

| Plan name | Classic Comprehensive | Pace 2 |

| Extensive in-hospital cover | ✔︎ | ✔︎ |

| Savings account for day-to-day benefits | 25% of your monthly contribution | 14% of your monthly contribution |

| Hospitals for planned procedures | Any | Any |

| Co-payments | Co-payments vary according to procedure taking place | No co-payments unless voluntary use of non-DSPs |

| Oncology Benefits | R500 000 per beneficiary per 12 month cycle. Unlimited once depleted with 20% co-payment | R192 126 per beneficiary for Biologicals and other high cost medicine. Subject to pre-authorisation |

| Maternity Benefits | ✔︎ With the Assisted Reproductive Therapy Benefit (ART). Pays up to R129,000 per person per year, up to a maximum of 75% of the Discovery Health Rate (DHR), when you use a Southern African Society of Reproductive Medicine and Gynaecological Endoscopy (SASREG) accredited facility in Discovery’s network. | ✔︎ In accordance with scheme guidelines |

| Chronic Illness Cover | Unlimited cover for 60 Chronic Conditions (including the 27 PMB conditions) | 27 CDL, 20 Non-Chronic Disease List (CDL) & 18 PMB Conditions Covered |

| Preventative Care Benefits | ✔︎ | ✔︎ |

| Basic Dentistry (Extractions, Oral Hygiene, Fillings & Consultation) | Subject to available savings | Subject to available savings or preventative benefit first and then limited to R8 009 |

| Over the counter (OTC) medicine | Subject to available savings | Subject to Available Savings and limited to R1 110 |

| External Appliance / Prosthesis | Subject to available savings and a predetermined amount for various procedures/benefits | Subject to available savings and a predetermined amount for various procedures/benefits. Additional co-payments may apply with non-DSPs |

| Self-payment gaps | ✔︎ | X |

| Dependants | Dependant Premiums applicable up to age 21 | Dependant Premiums applicable up to age 24 and registered students under the age of 26 |

Premium Medical Aid Plans

Executive from Discovery Health

Discovery Health created the Executive Medical Aid plan for complete in-hospital coverage. Benefits include 300% scheme tariff along with specialists contracted with Discovery Health, to be compensated in full. The Executive plan offers top notch benefits and access to savings for day-to-day expenses. The International Travel Benefit is a great perk for frequent travellers and can be considered for planned procedures.

Pace 4 from BestMed

The Pace 4 Medical Aid is designed for individuals with above average medical needs and costs. BestMed created this Medical Aid for those who seek maximum healthcare. Day-to-day expenses paid from your monthly contribution towards the plan. Pace 4 includes oncology benefits, optometry, a variety of assistive devices and much more.

| Service Provider | Discovery Health | BestMed |

|---|---|---|

| Plan name | Executive | Pace 4 |

| Extensive in-hospital cover | 300% of Scheme Tariff covered in full | 100% of Scheme Tariff covered in full |

| Savings account for day-to-day benefits | 25% of your monthly contribution | 3% of your monthly contribution |

| Hospitals for planned procedures | Any | Any |

| Co-payments | Co-payments vary according to the planned procedure taking place | No co-payments unless voluntary use of non- DSPs |

| Oncology Benefits | R500 000 per beneficiary per 12 month cycle. Unlimited once depleted with 20% co-payment. Subject to pre-authorisation | R569 070 per beneficiary for Biologicals and other high cost medicine. Subject to pre-authorisation |

| Maternity Benefits | ✔︎ With the Assisted Reproductive Therapy Benefit (ART). Pays up to R129,000 per person per year, up to a maximum of 75% of the Discovery Health Rate (DHR), when you use a Southern African Society of Reproductive Medicine and Gynaecological Endoscopy (SASREG) accredited facility in Discovery’s network. | ✔︎ In accordance with scheme guidelines |

| Chronic Illness Cover | Unlimited cover for 60 Chronic Conditions (including the 27 PMB conditions) | 27 CDL, 29 Non-CDL & 18 PMB Conditions Covered |

| Optical Benefit | Subject to available savings and capped at R10 100 per beneficiary per year. | Coverage is replenished every 24 months per beneficiary. |

| International Medical Travel Benefit (Only applicable to Medical Emergencies – Hospitalisation) | $1 million (USD) per person, per 90 day journey. Pre-authorisation required to receive travel documentation | R500 000 per person when travelling USA. All other countries, covered for R3 million per family, per 90 day journey |

| Over the counter (OTC) medicine | Subject to available savings | Subject to available savings |

| External Appliance / Prosthesis | R29 850 per family per year for hearing aids. Additional appliances subject to available savings | R35 842 per family per year, includes artificial limbs limited to 1 limb every 60 months. Additional appliances subject to available savings |

| Dependants | Dependant Premiums applicable up to age 21 | Dependant Premiums applicable up to age 24 and registered students under the age of 26 |

Prices

Discovery Health vs BestMed price and day-to-day savings comparisons

Individuals are encouraged to look at the respective Medical Aids in full as opposed to just the Rand value. A holistic review of each Medical Aid is necessary to highlight the coverage and benefits that are relevant to you and your loved ones. The knowledgeable Curemed Advisors are skilled in reviewing Medical Aids according to their unique offerings providing guidance throughout your healthcare journey.

| Service Provider | Discovery Health | BestMed |

| Plan name | Essential Saver | Beat 2 |

| Price and day-to-day savings | ⬆️Higher priced ✅10% allocated to savings | ⬇️Lower priced✅16% allocated to savings |

| Plan name | Classic comprehensive | Pace 2 |

| Price and day-to-day savings | ⬆️Higher priced ✅25% allocated to savings | ⬇️Lower priced ✅14% allocated to savings |

| Plan name | Executive | Pace 4 |

| Price and day-to-day savings | ⬇️Lower priced ✅25% allocated to savings | ⬆️Higher priced ✅3% allocated to savings |

Reviews

H3: Discovery Health and BestMed customer reviews

Discovery Health recent reviews

Trusted Customer

5 stars (19 March 2024)

Excellent service and guidance easy application process no hassles

Kavir Parthab

1 star (2 hours ago)

Service is horrendous. The call centre prompts alone are way too complicated. Takes forever to get ahold of someone to ask a simple question. The claims process is also riddled with issues. The scanned documents keep rejecting on the app due to the system issues on the back end. Took me more than 3 attempts to submit a simple claim.

(3 days ago)

I had a few changes to make on my existing policy with Discovery and I was assisted by Sinethemba Mthetho.

A very kind, patient and professional consultant… I like the fact that he addressed me in a language that I could understand and was kind enough to explain further about the benefits of my policy and how to benefit from them.

Thank you Sinethemba wenze njalo nakwabanye.

Rene

5 stars (18 March 2024)

I just want to thank God and thank discovery health for saving my son’s life (and the doctors) After he was in a motorbike bike accident, discovery paid 99.9% of his bills. I used to think my premiums were high, but after seeing how much the doctors and hospital charge the poor medical aid I was shocked and won’t ever complain about a premium again. Not once was I made to worry about any bill during this difficult time. He got the best care and made the best recovery I could imagine. Thank you so much.

4 stars (28 Jan 2024)

I was contacted shortly after my complaint and my issue has since been resolved

BestMed recent reviews:

5 stars (a month ago)

I am truly impressed with the medical scheme’s comprehensive coverage and efficient service. Truly a great organisation that lives up to their “Personally yours” brand promise. I highly recommend this scheme for anyone seeking reliable and compassionate healthcare support.

1 star (3 weeks ago)

Worst experience with these people. My mom was rushed to hospital with heart issues. Every claim was a hassle with them which stressed my mom out even more while in hospital. My total contributions has been much more than the claims they had to pay yet they still declined a lot of them. Money grabbing thieves, that is what they are

1 star (2 months ago)

Unfortunately, service from Bestmed is simply bad. Claims are never processed, so if you need to lodge a claim and expect to get any of your money back, you’re out of luck. Far better to go with another company, at least they will give you the light of day. It’s sad that Bestmed are incapable of performing, as they seemed to hold some promise.

5 stars (2 months ago)

Bestmed is a FANTASTIC Medical Aid. I have no problems with them at all. The employee’s are friendly and helpful. The app is fantastic as well. I often advise others to join them as they truly are a great Medical Aid. Keep up all the great work.

Conclusion

In summary, our comparison of Medical Aids available from Discovery Health and BestMed cover three tiers: standard, comprehensive, and premium plans. As Independent Advisors we offer objective assistance, exploring various plans across different schemes to align with your custom needs and budget.

Focusing on a holistic approach, Curemed’s Medical Aid Advisors place emphasise on the significance of considering all aspects when it comes to Medical Aid. Therefore, there is no definitive answer to a superior Medical Aid. The right Medical Aid is the one best suited to your individual needs and overall well-being. Curemed is an Independent Advisory Firm dedicated to demystifying the Medical Aid world and prioritising your healthcare and financial needs. For a personalised Medical Aid quote, click here:

Disclaimer: Terms and Conditions apply. This blogpost and the information contained within it is intended for information and consumption purposes only and does not by any means supersede the Rules of the Scheme. In the event of any discrepancy between this mailer and the Rules of the Scheme, the Rules of the Scheme will prevail.