Momentum Health vs Discovery Health are two of the most popular Medical Schemes in South Africa. Momentum Health has been in the industry for over 50 years with one of its specialities being Medical Aid. Along with medical aid, Momentum also offers financial advice, life insurance, short-term insurance, Wills, Trust and investment products available to the public and institutions.

Discovery Health started in 1992 as a financial services organisation offering healthcare, life insurance, short-term insurance, long-term savings and banking. All the above services are available nationwide to both individuals and businesses.

The importance of selecting the right medical aid provider

When faced with the complex decision of selecting a suitable medical aid for you and your needs, Momentum Health vs Discovery Health is a comparison worth reviewing. Identifying the right medical aid for your individualised needs is an important consideration due to the direct impact it can have on both your current and future financial position.

Selecting the correct medical aid for yourself and your loved ones, ensures financial stability through comprehensive cover and avoiding potential shortfalls in your healthcare plan. The right medical aid provider is the one that offers the ultimate plan tailored to your healthcare needs and budget. Seeking medical aid can be overwhelming with an influx of information which is why Curemed is #alwaysthereforyou.

Curemed: Your guide to selecting the ideal medical aid

Curemed is an independent Financial Advisory Firm specialising in medical aid. We’re dedicated to finding the optimal healthcare solution for you and those close to you. Operating independently enables us to offer unbiased assistance, steering clear of any favouritism towards a specific medical aid provider. Our loyalty is to you and your needs.

Partnering with the top eight medical aid providers in South Africa, Curemed ensures extensive care when it’s needed most. Our experienced medical aid advisors simplify the complexities of healthcare solutions, empowering you with the knowledge necessary to choose the right medical aid suited to your needs.

Benefit from obligation-free, comparative, complimentary and personalised quotes from Curemed’s team of expert advisors. For the full list of services offered by Curemed, refer to the services available on our website: www.curemed.co.za.

- Health

- VIP Admin services (CureClub)

- Wealth

- Gap Cover

- Insurance

- Business Solutions and Employee Benefits

Curemed’s network of healthcare providers

Coverage and Benefits

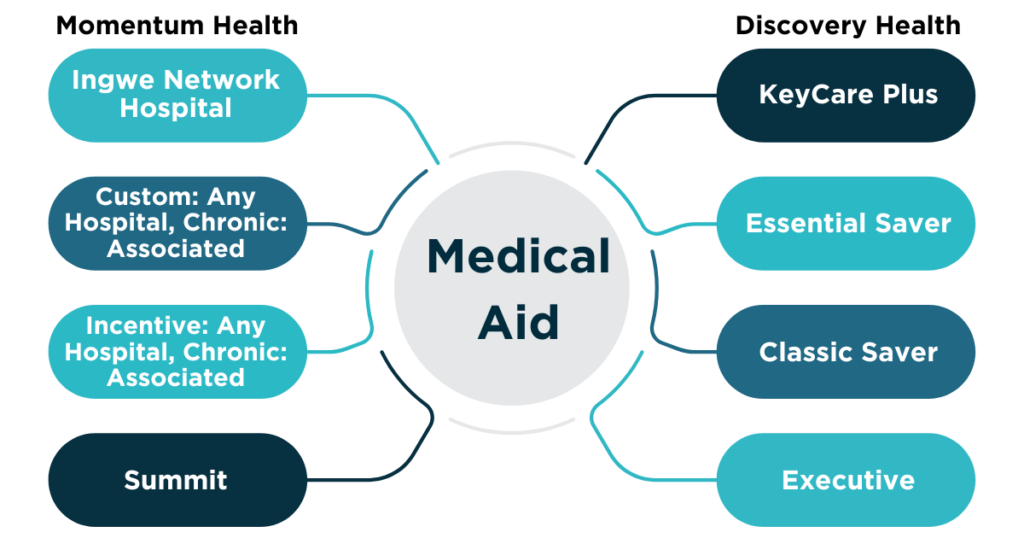

Momentum Health and Discovery Health offer a wide range of popular medical aid plans. A comparative assessment of these plans ranging from standard, intermediate, comprehensive and premium health solutions highlights the differences between the plans and their benefits. This review provides informative knowledge used to select a suitable medical aid tailored to your individualised needs.

Momentum Health Coverage and Benefits:

Standard Medical Aid Plan

Ingwe Network Hospital from Momentum Health

The Ingwe Network Hospital is an affordable, entry-level medical aid catered to first time employees or students.Your monthly contribution is based on your income and family composition. Utilising hospitals under the Momentum Health network entails using specified private healthcare facilities or any state hospitals. This ensures 100% of hospitalisation fees covered as per the Momentum Health Medical Scheme Rate. Deviating from network-affiliated hospitals results in a 30% co-payment.

By using the network providers, you get hospital and designated day-to-day cover as well as predetermined chronic illness benefits.It is worth noting that the Ingwe Network Hospital does not have the option of adding Healthsaver.

Intermediate Medical Aid Plan

Custom: Any Hospital, Chronic: Associated from Momentum Health

The Custom: Any Hospital, Chronic: Associated medical aid plan, is a cost-effective solution to accessing private healthcare. This package includes 100% of hospital fees covered as per the Momentum Health Medical Scheme Rate. Unlike the Ingwe Network Hospital medical aid, you’re able to visit any healthcare facility as opposed to sticking to specific network hospitals. However for chronic benefits, utilisation of associated healthcare facilities is necessary for coverage by Momentum Health and avoiding co-payments. The above medical aid offers flexibility with the option to add healthsaver in order to gain access to day-to-day benefits.

Comprehensive Medical Aid Plan

Incentive: Any Hospital, Chronic: Associated from Momentum Health

The Incentive: Any Hospital, Chronic: Associated offers extensive hospital cover through any healthcare provider and 10% savings for day-to-day medical expenses. If the 10% savings are not used within the year, they will be carried over. Your Medical Savings Account (MSA) is pro rata meaning that it accumulates over time and is distributed in equal portions. If you need more than 10% savings for day-to-day expenses, you can include Healthsaver to your plan.

This medical aid includes 200% of hospital fees covered as per the Momentum Health Medical Scheme Rate. For chronic benefits, one makes use of associated medical facilities. Using associated providers for your chronic cover enables you to save on your monthly contribution. Associated providers consist of network GPs for your chronic script and MediPost courier services for your chronic medication.

Premium Medical Aid Plan

Summit from Momentum Health

The Summit option is designed for individuals and collectives who require comprehensive in-hospital cover, day-to-day and chronic benefits from any provider of their choice. The day-to-day benefits cover everyday medical expenses, such as doctor visits and prescribed medication.

With the Summit medical aid, you get R31 300 (subject to sub-limits) to cover day-to-day expenses per beneficiary, each year. If you don’t use the full amount in one year, it will not be carried forward. The following year will begin again with R31 300, provided you remain on the same plan. There is a Health Platform Benefit which covers various benefits such as preventative screening tests, selected check-ups and more.

Discovery Health Coverage and Benefits:

Standard Medical Aid Plan

KeyCare Plus from Discovery Health

The KeyCare Plus is an income based budget friendly, entry-level medical aid tailored to first-time employees or students. Discovery Health covers 100% of the scheme tariff for in-hospital cover. Full cover for chronic medicine and for all Chronic Disease List (CDL) conditions when using a network pharmacy. Opting for providers outside the Discovery Health network, will not be covered by Discovery Health.

Intermediate Medical Aid Plan

Essential Saver from Discovery Health

The Essential Saver medical aid offers covers 100% of the scheme tariff for in-hospital expenses. 10% of your in-hospital coverage is allocated to your MSA. These savings can be used for day-to-day healthcare needs according to your individualised needs. Your savings are available to you immediately and if they remain unused for the year, they will carry over to the next year provided you stay on the same plan.

The day-to-day Extender Benefit (DEB) is available for additional benefits. Chronic medicine is covered for all CDL conditions when using a network pharmacy. The Essential Saver is an affordable solution to access private healthcare facilities and services when making use of network providers.

Comprehensive Medical Aid Plan

Classic Saver from Discovery Health

The Classic Saver provides full in-hospital cover for specialists and up to 200% of the Discovery Health Rate for other healthcare professionals. This medical aid offers coverage for chronic medicine for all CDL diagnoses when making use of a network pharmacy. The MSA available on this plan can be used for your daily healthcare needs. 20% of your plans in-hospital coverage, is dedicated to your MSA.

Similarly to the Essential Saver above, the DEB is available for additional benefits once your MSA is depleted. The Classic Saver is an economical solution to accessing private healthcare facilities whilst offering sufficient coverage for your chronic needs.

Premium Medical Aid Plan

Executive from Discovery Health

The Executive plan is a comprehensive medical aid with broad healthcare coverage. Individuals seeking such cover desire an elevated level of coverage for in-hospital expenses, chronic care, everyday benefits and other medical costs. The Executive plan covers 300% of Scheme Tariff Specialists.

Furthermore, 25% of the in-hospital coverage is allocated to your MSA. With this medical aid, there is specific medical coverage for international travel. The above plan also provides extensive benefits for maternity and early childhood, including certain health services pre and post birth.

Momentum Health vs Discovery Health – Price Comparison

Medical Aid Pricing:

Medical Aid providers such as Momentum Health and Discovery Health, operate according to Medical Scheme Rates (MSRs) which are predetermined amounts that medical schemes contribute towards specific healthcare treatments and procedures. These amounts are stipulated by your medical aid provider and differ according to the plan type.

Standard and intermediate plans such as the aforementioned: Ingwe Network Hospital, KeyCare Plus, Custom: Any hospital, Chronic: Associated, Essential Saver offer coverage at 100% of the MSR (network dependant). Whilst higher medical aids such as the Incentive: Any hospital, Chronic: Associated and the Classic Saver, provide cover for 200% of the scheme rate (network dependant). Premium medical aids like the Summit and Executive plans, include 300% of the MSR.

Medical Scheme Rates versus Healthcare Industry Pricing

It’s crucial to consider the percentage of coverage available from your specific plan and provider. The healthcare industry and medical specialists regularly charge fees exceeding these rates with no formal regulation controlling their pricing.

Medical Scheme Rates are determined by medical aid providers based on risk assessment, considering the frequency of claims and available funds. However, the difference between what’s covered by the medical scheme and the actual charges from healthcare providers, known as medical shortfalls or co-payments in-hospital, often falls on individuals to cover which has a direct impact on your financial stability.

To safeguard oneself against potential shortfalls, it’s crucial to identify the portion of medical costs covered by your medical aid . Additionally, adhere to network providers as outlined in your plan or a payment gap can arise as well as hefty co-payments. Furthermore, secure additional Gap Cover to protect yourself from the possibility of financial ruin.

Seeking guidance from independent Medical Aid Advisors, such as Curemed, assists with navigating the complexities of medical aid and ensures you choose the right plan tailored to your unique needs.

Pricing Table: Momentum Health vs Discovery Health

As always, Curemed encourages individuals to thoroughly examine the entirety of each medical aid rather than solely focusing on the Rand value. Completing a comparative review of various medical aid plans, assists in selecting the right medical aid for you and your loved ones.

| Service Provider | Momentum Health | Discovery Health |

|---|---|---|

| Plan name | Ingwe Network Hospital | KeyCare Plus |

| Pricing | ⬇️Lower priced | ⬆️Higher priced |

| Plan name | Custom: Any Hospital, Chronic: Associated | Essential Saver |

| Pricing | ⬆️Higher priced ✅Healthsaver benefits optional | ⬇️Lower priced ✅10% allocated to savings |

| Plan name | Incentive: Any Hospital, Chronic: Associated | Classic Saver |

| Pricing | ⬆️Higher priced ✅10% allocated to savings✅Healthsaver benefits optional | ⬇️Lower priced ✅20% allocated to savings |

| Plan name | Summit | Executive |

| Pricing | ⬆️Higher priced ✅R31 300 day-to-day benefits (non-accumulative)✅Healthsaver benefits optional | ⬇️Lower priced ✅25% allocated to savings (R30 900 accumulative) |

Member Reviews and Satisfaction

Whilst the below customer reviews presents valuable insights into each medical aid, it is important to note that dissatisfaction can often be a result of not fully understanding the terms and conditions of the plan to begin with. Which once again, highlights the importance of comprehending the benefits and coverage of your medical aid prior to committing to it.

Momentum Health Member Reviews:

Sithembile

One star (13 April)

Momentum not paying claims

I was hospitalised last year 2023 for a life threatening condition, authorization was granted for the procedure. A few months later I got notified by the hospital that there is an outstanding amount of about R17 000 that I need to settle as the medical aid did not pay. I followed up with Momentum, they told me to get a motivation letter from the hospital as to why they should pay for those items. I did all of that, the hospital sent the motivation letter to Momentum on 3 April 2024 but till today Momentum has not repaid. A follow up was made but still no response. My hospital account is now being handed over. I am very disappointed with Momentum, I have been experiencing claim issues with them as there was another which I sent to my gap cover but gap cover advised that they should have paid. With the help and follow up from my gap cover provider they ended up paying it.

Kupps M

3 star (01 March)

Momentum has no heart for senior people

I have been a member of Momentum for a very long time. I am now medically boarded and have been asking for help with a quote on medical aid and no response. My wife and I are unable to survive with the hefty payment they take from me. I am left with a R1000 for the whole month. Everytime i have to call which in itself is so costly. The best part is I always have to pay in because their medical aid doesn’t cover most of this. Can some help a desperate pensioner!

Naadhira A

5 stars (06 March)

Low Prices

Momentum is a great company with low prices compared to other health insurance and are very helpful over the phone

Discovery Health Member Reviews:

Veronica B

1 star (16 April)

Pathetic Medical Aid

I’ve been with Discovery since 1999 – 25 years. At the moment I’m paying almost R4000 per month. They give me a medical savings amount of plus minus R6000. This has to cover doctors (GP’s) specialists and medicine. They refuse to pay for my depression tablets because apparently I’m on a low plan. I have only been in the hospital once since I joined. I have to go for surgery now and believe it or not they offer to pay a third (R5000) of the dr’s account. I must pay the rest. I understand that the Dr is not contracted in either of them but gee whizz I am paying the amount of his fees back to discovery in four months. What do they do with the rest of the money? My son was dependent under me. They refused to pay for his Insulin. He had to go over to another medical aid which is way better than them and he pays R1000 less than me.

Erin A

3 star (05 April)

Unclear Scheme Rules

Just cancelled my Discovery. I recently had to downgrade because we could no longer afford the high premiums. I switched to the Keycare Start Plan. Everything was inconvenient and the strict rules made it difficult for me to get them to pay for doctors and medication. I had to be embarrassed at Clicks when I was told that I would need to pay for my medication because they were not the right pharmacy. I paid and phoned and was told that there was only one pharmacy in my area I could go to and that my nominated doctor had to prescribe it. I would go for tests or see specialists only to be told I had to go see my nominated doctor first who will then recommend a network specialist and even then might not pay all of it. Not user friendly. Requires a lot of time and effort. You have to read or enquire to find out the rules. But they can easily take your contributions every month.

Carla L

5 stars (03 April)

Customer service for the win

Nobody understands their medical aid, not really. I called the contract centre and spoke to a friendly lady, she was patient with me and answered my questions, and all the follow-up questions, she did it thoroughly with understanding. I’m pretty sure she ‘dumbed it down’ for me. Which I appreciated, as I didn’t have a comprehensive glossary at hand with all the lingo. 17/10 excellent.

Summary of key points discussed in the comparison.

Comparing the popular South African Medical Schemes, Momentum Health and Discovery Health, identifies the similarities and differences between the two. Both providers offer a wide range of services catering to individuals, families and businesses nationwide. However, identifying your specific health needs is the determining factor when considering the right medical aid for you. Failure to do so can have a negative impact on both your health and financial status.

Highlighting the benefits of each plan is important but so is considering the potential shortfalls relevant to each option. Seeking assistance from independent advisors like Curemed, offers additional guidance in your healthcare journey. Through considering and understanding a variety of medical aids, you empower yourself in making informed decisions that are advantageous to your future and present self.

Overview of Momentum Health:

Momentum Health ranks amongst the top three largest medical schemes in South Africa, covering more than 130 000 families. It provides various medical aid plans catering to different needs and budgets, with a focus on affordability and quality care. Like most South African medical schemes, Momentum Health is governed by the Medical Schemes Act and regulated by the Council for Medical Schemes.

Overview of Discovery Health:

As it currently stands, Discovery Health is South Africa’s largest medical scheme. Discovery Health has a market share of 57.6% as reported by the Council for Medical Schemes Annual Report for December 2021. As most medical aids, Discovery Health is governed by the Medical Schemes Act and regulated by the Council for Medical Schemes.

Disclaimer: Terms and Conditions apply. This blogpost and the information contained within it is intended for information and consumption purposes only and does not by any means supersede the Rules of the Scheme. In the event of any discrepancy between this mailer and the Rules of the Scheme, the Rules of the Scheme will prevail.